Are you a high performance mortgage marketer looking for new, innovative strategies to fill your funnel, but wish your lead to contact rate was better?

You are expected to keep acquisition costs low and conversion rates high, but with mortgage qualification tightened and a complex lending process, it's getting harder and harder to show results.

Automated texting can change everything. Instead of filling the top funnel only to end up chasing leads down, your automated texting robot keeps the pipeline moving. No more leads falling through the cracks when they're handed off from marketing to sales, or when they need a few more days, weeks or even months of nurturing before making that big decision. Automated texting takes care of the handoffs, the nurturing and so much more.

Here's what automated texting is, why it works, and 3 ways to use it to engage and convert mortgage leads...

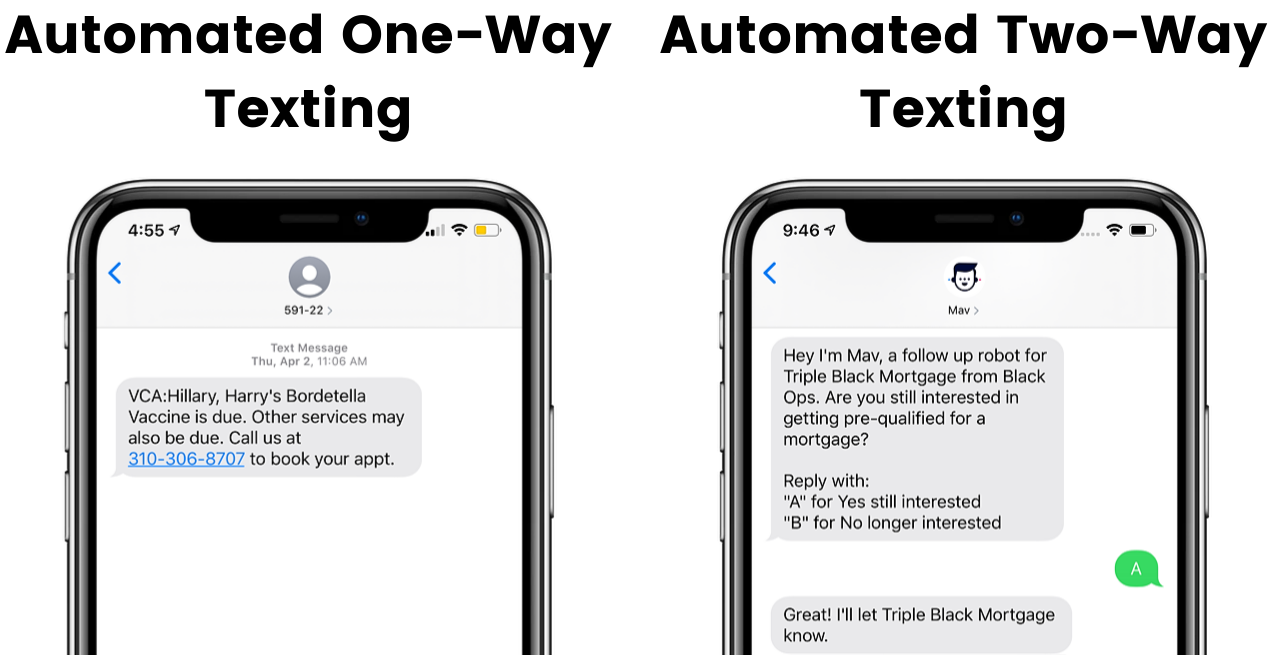

Like the name suggests, automated texts are SMS messages that are triggered or scheduled to send on their own. You might be familiar with the most common type of automated texts, one-way SMS broadcasts or a call-to-action outside of the conversation (like a link or "call me back"). Your customers can't reply to these texts.

Automated two-way texting enables your business to have conversations with prospects, leads and customers. Instead of static links and spam, the recipient can interact with an automated robot, text back and complete tasks in a conversation. This instantly unlocks value for the user, like getting pre-qualified or expressing interest in a timely offer, and for the business, by finding out if they're interested and continuing to nurture them throughout the entire sales process (automatically).

We know that texting is the preferred method of communication for customers, but how exactly can mortgage marketers use it?

In an actionable, engaging conversation a lead can tell you more about what they're looking for and find out if they pre-qualify for a mortgage. Once they start the conversation, your texting robot will make sure they complete the process, making abandoned applications are a thing of the past.

With newer, stricter guidelines on approvals that are changing rapidly, a lead that isn't qualified today might be in 30-60 days. When done manually, that nurturing process feels endless. With automated texting, you can continue to nurture and keep those leads engaged for as long as it takes. Using the information you already have, you'll know the exact right time to re-engage them with updates and take next steps.

Using the data and market insights you already have, your texting robot can programmatically trigger texts to customers with refinance and cash out offers that are personalized and relevant. Reach the exact right customer at the exact right time with an offer they'll want to act on right away.

With the goal of identifying borrowers who would benefit from low rates, one senior loan officer used Mav to re-engage 150 past closed loans with specific refinance opportunities.

In just 1 week, 26 customers re-engaged and scheduled a time to discuss unlocking over $5 million dollars in additional loan volume.

And, it was all done on autopilot. Instead of spending hours each day cold calling these borrowers, the interested ones were delivered to him, ready to go. That's the magic of automated texting at work. 🔮